Articles

Marie Ambrosino Named a 2025 Top Business Manager by The Hollywood Reporter

Our firm is pleased to congratulate Marie Ambrosino on being named a 2025 Top Business Manager by The Hollywood Reporter. This prestigious list recognizes the business managers of some of the biggest names in Hollywood, and highlights how their wisdom and expertise help clients navigate the ever-changing entertainment landscape. Notably, this year marks Marie’s fifth consecutive appearance on the coveted list, and is a testament to the continued success of her practice and stature in the business management arena. In her profile for the issue, The Hollywood Reporter emphasizes Marie’s decades of experience advising high profile clientele. While she tends…

Read more...

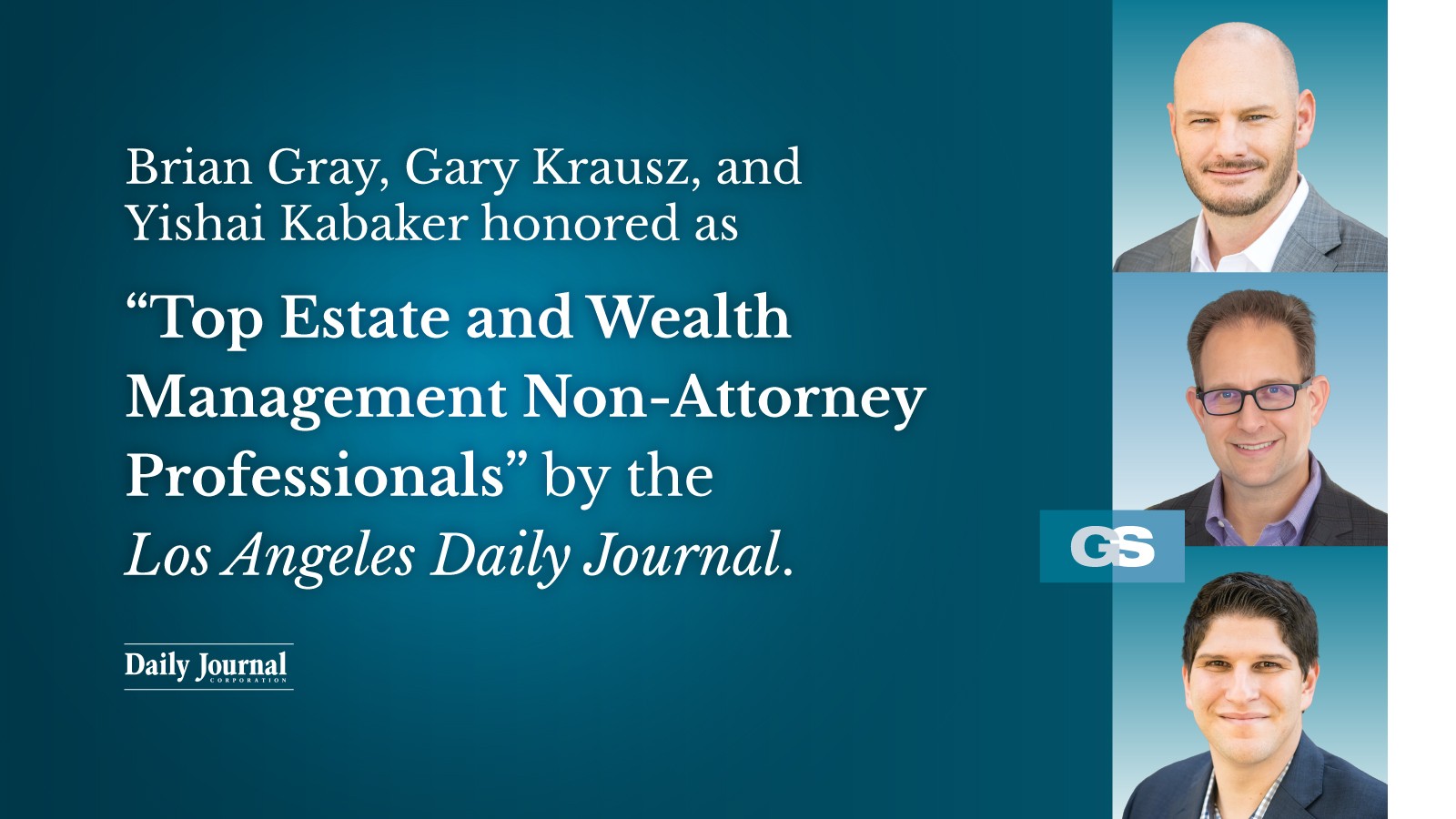

Daily Journal Names Brian Gray, Gary Krausz, and Yishai Kabaker Among “Top Estate and Wealth Management Non-Attorney Professionals” of 2025

Read more...

Why Gursey?

Why Gursey Schneider? Because we don’t just develop accounting professionals – we invest in people. As Tax Partner Keith Dolabson describes, a career with our firm provides growth, mentorship, and lifelong learning opportunities.

Read more...

Tax Relief for Natural Disaster Victims

Our firm offers essential information on disaster relief and tax benefits for individuals and businesses affected by natural disasters. Find guidance on government measures, financial assistance, and recovery resources to help you navigate challenging times.

Read more...

The Evolving Story of Qualified Small Business Stock

Qualified Small Business Stock (QSBS) shows how tax policy can drive entrepreneurship. Launched in 1993, it evolved to offer up to 100% capital gains exclusion and was modernized in 2025 to include tiered benefits and inflation-adjusted limits. Despite state-level differences, QSBS continues to support long-term investment and innovation in high-growth sectors.

Read more...